Car allowance tax calculator

Work-related car expenses calculator. Next your tax band is applied depending on whether.

Personal Taxation Of Car Allowance In Canada Youtube

This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles.

. Under 15000 Under 20000. 580 - 619. If you have the choice of either a company.

Your car allowance is calculated by simply being added to your existing income after deduction of Personal Allowance. Current 01 March 2022 - 28 February 2023. Tax rates 2022-23 calculator.

Tax rates 2021-22 calculator. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Ad Calculate Your Monthly Car Loan Payments With Tax And See Which Cars Fit Your Budget.

Car allowance is based on the cost plus VAT x. Across the industry on average. Payment of a car allowance gives rise to a number of tax questions.

For example a survey mentioned on eReward found that the average car allowance differs from one employee level to the next in the UK. It can be used for the 201314 to. As amended upto Finance Act 2022.

Your company may have several tiers of monthly allowance and these could depend on the following factors. Tax rates 2021-22 calculator. 01 March 2021 - 28 February 2022.

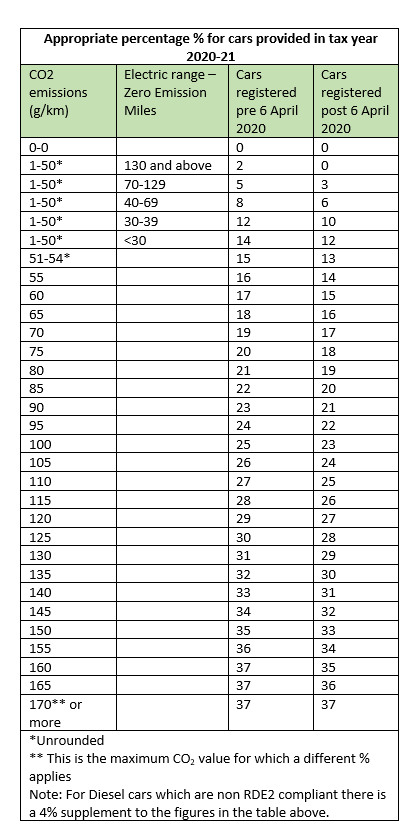

You can calculate taxable value using commercial payroll software. Or you can use HMRC s company car and car fuel benefit calculator if it works in your browser. Automobile Benefits Online Calculator - Disclaimer.

Car Allowance Salary Sacrifice Or Company Car Free Comparison Calculator Download Youtube. 2023 Car Allowance Calculator. Usually the vendor collects the sales tax from the consumer as the consumer makes a.

Shop Cars By Price. 28 August 2016 at 1131AM. Select the nature of.

Add the car allowance to the basic salary and reduce the pension so that the actual amount in for pension is. Estimated tax title and fees are 1000 Monthly payment is 405 Term Length is 72 months and APR is 8. Experian 2020 Q1 data published on August 16 2020.

Taxability of Motor Car Perquisite. Ad Get Assistance Managing Unexpected Car Problems Mechanic Bills and More with Money Map. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value.

Take Control of Your Unexpected Car Expenses. Your results You can use this service to calculate tax rates for new unregistered cars. Tax payments 3.

Income Tax Department Tax Tools MotorCar Calculator. Taxability of other than Car Perquisite. The Automobile Benefits Online Calculator allows you to calculate the estimated automobile benefit for employees.

Discover The Answers You Need Here. 10300 for company heads directors and. Super contribution caps 2021 - 2022 -.

2022 Car Allowance Calculator. 625 percent of sales price minus any trade-in allowance. Know Your Payment Options While You Shop With No Hit To Your Credit Score.

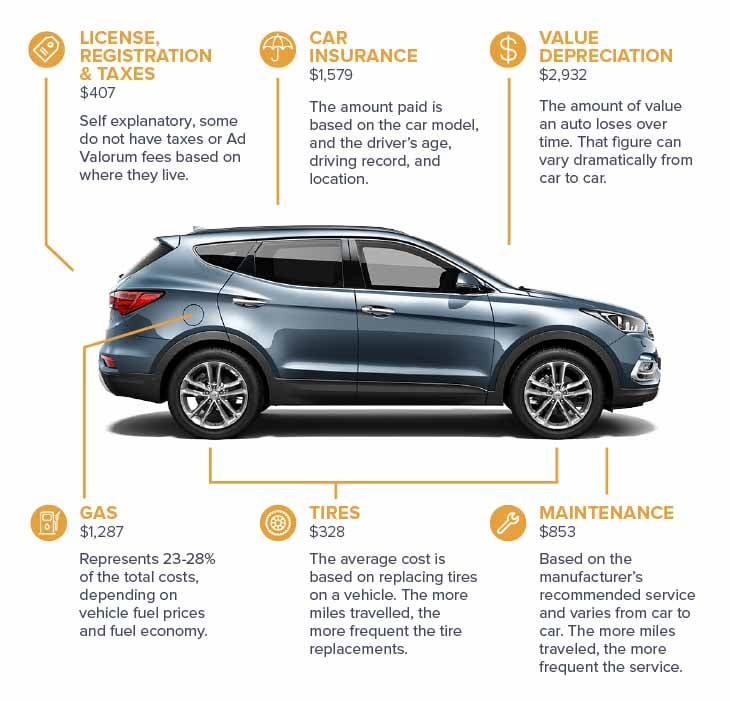

Get Step-by-Step Guidance with AARP. The average car maintenance costs in your area average.

How To Calculate A Fair Car Allowance

2022 Car Allowance Policy Calculate The Right Amount

Automobile Benefits Canada Ca

How To Calculate Your Automobile Taxable Benefits For The Purposes Of The T4 And Rl1

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

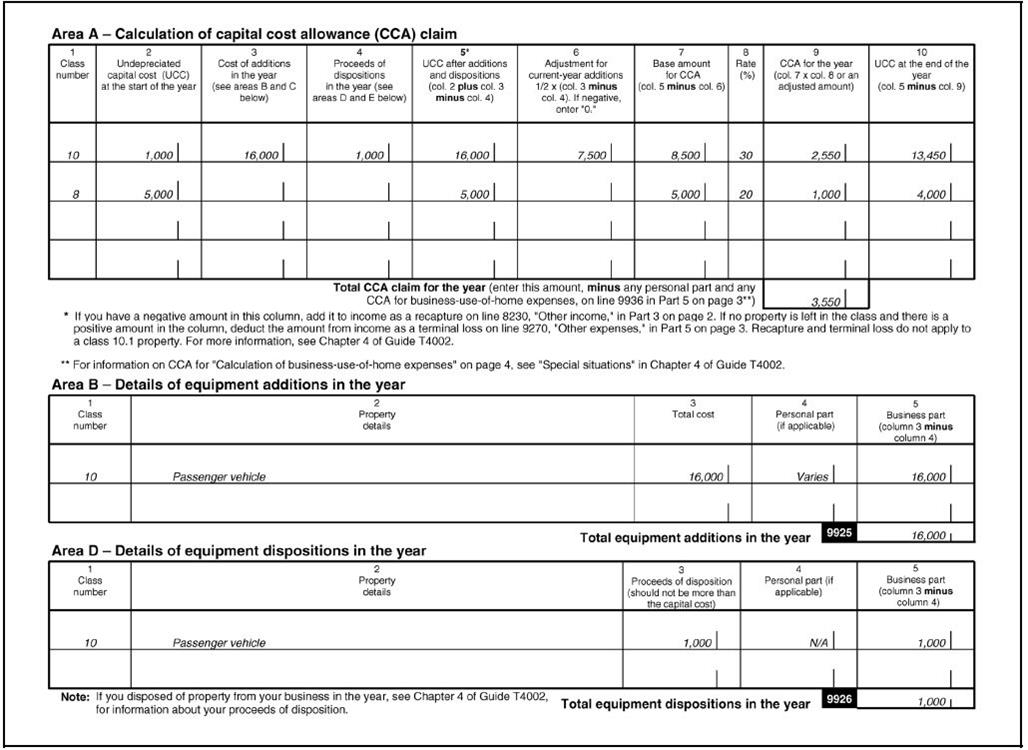

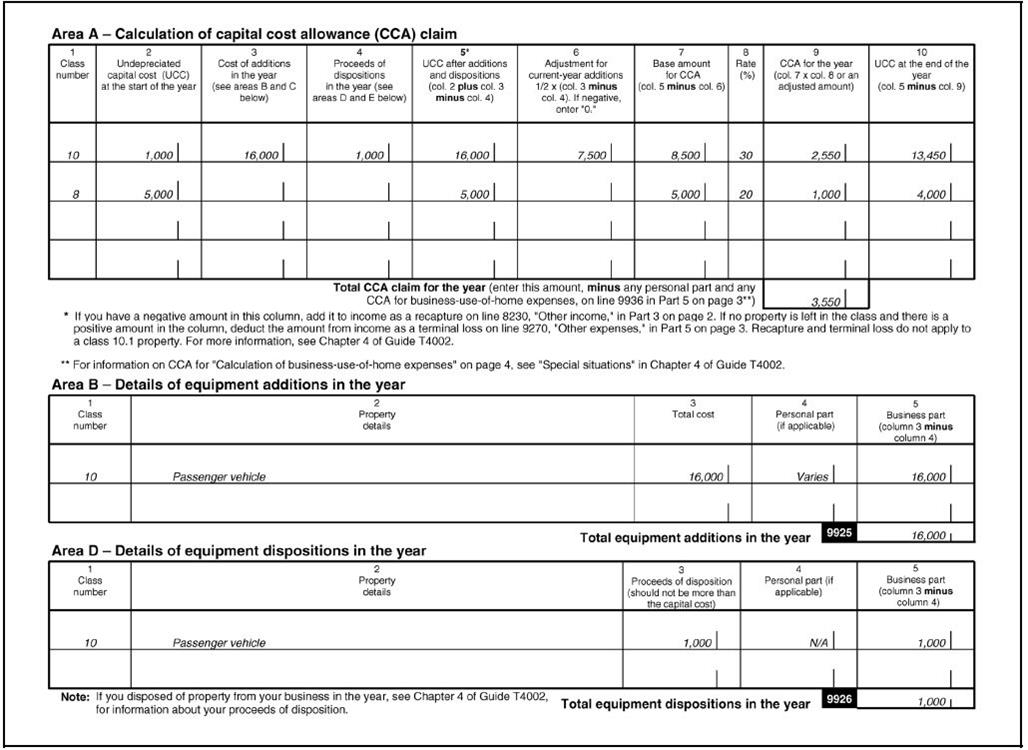

How To Calculate Capital Cost Allowance Solid Tax

Tax Planning Q A For Canadian Physicians Dr Bill

Car Allowance Salary Sacrifice Or Company Car Free Comparison Calculator Download Youtube

2022 Everything You Need To Know About Car Allowances

Car Benefits Data Input Calculation 2020 21 Moneysoft

Company Car Or Car Allowance What Do I Choose Youtube

2022 Everything You Need To Know About Car Allowances

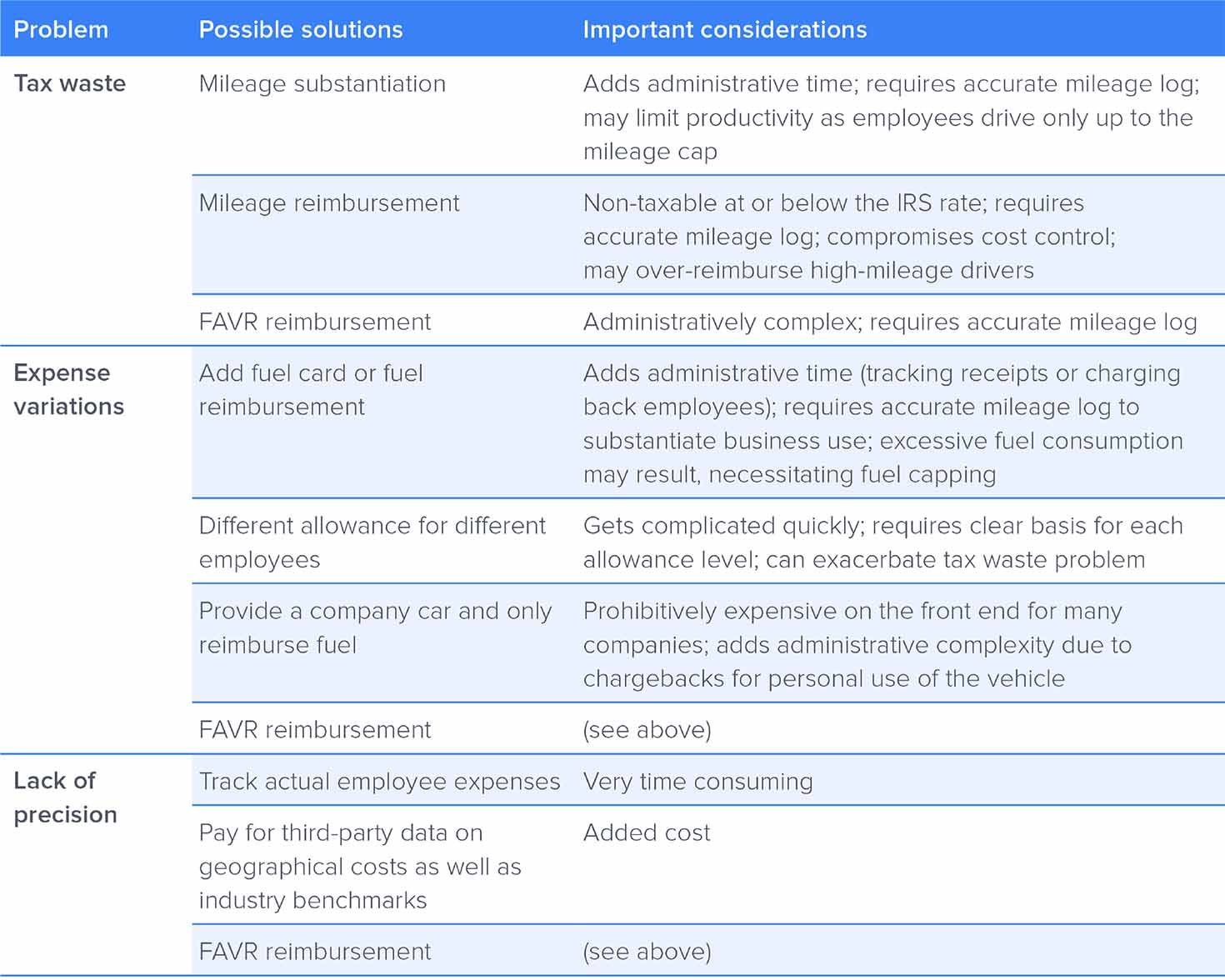

How To Create An Effective Car Allowance Policy I T E Policy I

Helpful Resources For Calculating Canadian Employee Taxable Benefits The Art Of Accounting Burlington

2022 Everything You Need To Know About Car Allowances

Allowance Vs Cent Per Mile Reimbursement Which Is Better

What Is The Average Car Allowance For Executives I T E Policy I